- Canadian Dividend Investing

- Posts

- Why This Unloved Telecom Could Outperform

Why This Unloved Telecom Could Outperform

Two important things investors are missing about Rogers Communications

Periodically, CDI will share paid pieces with free subscribers. This was originally published on July 7th. To ensure you get full access to the paid tier of this newsletter, upgrade your subscription today. Just $15 per month, or save 17% by signing up for a yearly subscription.

If I had a time machine and I was going to use it for the sole purpose of getting younger Nelson wealthy, a pretty easy strategy would be to tell my younger self to buy Canadian telecom stocks.

Yes, there are names that performed a whole lot better than the telcos — Apple and Monster Energy come to mind — but Canadian telecom stocks would have been pretty solid choices.

Including reinvested dividends, each name did the following over the last 20 years:

Telus - 867.70% (12.01% CAGR)

BCE - 425.98% (8.65% CAGR)

Rogers - 906.19% (12.53% CAGR)

Shaw - 897.79% (12.24% CAGR)

If a younger Nelson would have invested just $40,000 in to an equal weighted basket of the four major Canadian telecoms — so $10,000 each — then he’d be sitting on a portfolio of just four stocks worth some $350,000. That portfolio would be spinning off approximately $15,000 annually in passive income, too.

I remember back to when I was first picking stocks in the early 00s and let me tell you, a boring portfolio of telecoms, banks, and consumer staples was a lot better than the crap I was picking. Yes, the first stock I ever bought was TD Bank, but I quickly went downhill from there. I bought energy stocks with big yields. I bought terrible U.S. banks because they were selling at a discount to book value. And I bought way too many struggling retailers.

Fortunately, I learned from my mistakes. Even if this education took way longer than I’d care to admit.

I have no clue if the Canadian telecoms will put up similar returns going forward, but I’m confident enough to have big chunks of my portfolio in Telus and BCE, as well as a smaller chunk in the more upstart rival, Quebecor. I also own Rogers in portfolios I manage for family members, capital I plan to inherit someday. So I treat those accounts pretty much exactly as I treat my own money.

Many Canadian investors have given up on Rogers Communications (TSX:RCI.B) for a few different reasons. Perhaps most importantly, the stock has done pretty much nothing in the last five years. Dividend growth has stalled, with just one increase after 2015. Much of this underperformance is blamed on family infighting, drama made public once it invaded the corporate boardroom.

These are certainly issues, but this analyst thinks there are two important things investors might be missing about Canada’s largest wireless carrier. Rather than focus on the entire company, I’m going to take a closer look at these two “hidden” parts of Rogers and why they, combined with a solid base, make Rogers an interesting stock today.

Sports franchises

If 20 year-old Nelson really wanted to make some money (and was already rich), then he really should have purchased a professional sports team.

There have been some truly incredible returns on sports teams, and not just good teams, either. Let’s look more specifically at a few, although most sports teams have delivered similar returns.

The Steinbrenner family purchased the New York Yankees for $8.8M back in 1973. These days, Forbes estimates the team is worth $7.1B. Turning $8.8M into $7.1B in 50 years translates into a return of approximately 14.4% per year.

Much hated Washington Commanders owner Daniel Snyder paid $800M for the franchise back in 1999. He recently sold to a group led by Josh Harris and Magic Johnson for $6.05B. This translates into a 9% return, plus any profits generated by the investment over the years.

(That last part is pretty substantial. According to Forbes the Commanders generated $130M in operating income in 2022 alone, and the team was comfortably profitable most every year Snyder owned it.)

Eugene Melnyk paid $92M to purchase the Ottawa Senators from bankruptcy in 2003. His daughters recently sold the team for a price tag that reportedly will flirt with $1B. That translates into a return of approximately 12.5% per year, although Melnyk reportedly owed money against the team as he borrowed to repay operating losses.

One more. Michael Jordan recently reached an agreement to sell his majority ownership stake in the Charlotte Hornets for a $3B valuation. Jordan paid $275M for his stake in 2010.

The interesting thing is each of the three recent sales I highlighted (Commanders, Senators, and Hornets) were at valuations higher than where Forbes valued each team.

Here’s why this matters for Rogers.

Rogers is a big investor in top Canadian sports franchises. It, along with BCE, each paid $533M for respective 37.5% stakes of Maple Leaf Sports and Entertainment (MLSE), back in 2011. MLSE owns pretty much every sports team of consequence in Toronto, including the Maple Leafs, Raptors, Marlies, Toronto FC, and, most recently, the Toronto Argonauts.

The only other sports franchise of any importance in Toronto is the Blue Jays, and Rogers owns that franchise outright. It purchased an 80% stake in the team (and its home stadium, Rogers Centre) in 2000 for $165M, eventually buying the remaining stake from original owner Interbrew in 2004.

The background is interesting — at least to a sports business nerd like me — but ultimately what matters here is the value of each sports franchise.

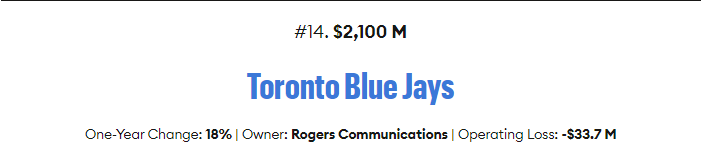

For the Blue Jays, we’ll just use Forbes’ valuation, which says the franchise is worth US$2.1B. That’s probably a little bit light, but we’ll be conservative here.

MLSE is pretty easy to value too, thanks to recent news that the Tanenbaum family is about to sell part of its 25% ownership stake to Omers for a valuation of US$8B. That valuation would give us a value of US$3B for Rogers’s MLSE stake.

Add up the two, and Rogers has sports franchise value of US$5.1B on its balance sheet. Convert that back to canuck bucks — which is what I call every loonie I find now — and we get a valuation of $6.8B.

Rogers has approximately 505M shares outstanding, meaning these sports franchises have a value of $13.46 per share. That works out to 22% of the value of each share locked into sports franchises.

Here’s why I think the market is missing this value. Rogers doesn’t break down the results of each team; they just group the whole thing in a larger media division, a division that hasn’t been terribly profitable (on an earnings basis, anyway):

Those numbers… are not great. Especially when you compare them to the rest of the business.

Sports teams are kind of a weird asset. Most consider a breakeven year pretty good, with many owners having to subsidize the operation as it regularly dips into the red. The Blue Jays are no exception, with Forbes reporting the team had an operating income of negative $33M in 2021.

Even the Maple Leafs — who, according to reports, are consistently profitable — don’t generate huge cash flows. The team’s valuation is reportedly north of US$2B, yet it earned about $100M in operating earnings — at least according to Forbes.

What it all boils down to is this. Rogers has a media division that is likely worth $15+ per share, a divisions that is quietly growing at 7-10% per year but it isn’t reflected in earnings. That’s 25% of the company that the market is completely ignoring. Yet there it is, slowly gaining value in the background.

For a second let’s assume Rogers media division doesn’t exist and just look at the rest of the company. The rest of the company is worth $45 per share and earned $3.79 in adjusted earnings in 2022, earnings that excluded costs associated with the Shaw acquisition. Since the media division essentially broke even in 2022, that values the rest of the company at approximately 12x earnings.

The problem with valuing Rogers in this way is there’s only one way to crystalize the value of the sports teams. They’d have to sell. And I just don’t see that happening, at least anytime soon. These teams provide all sorts of cheap content for their media division, which in turn sells cable subscriptions. Like a lot of millennials, your author doesn’t have cable. But I do have Netflix, TSN, and Sportsnet streaming packages. Sportsnet would be the last package I’d cut from those three, too.

The good news is there’s another reason I think Rogers shares could head substantially higher — and not because of the “hidden” assets or anything fancy like that. No, I’m talking about good ol’ fashioned earnings growth.

Do you believe analysts?

Now that Rogers has officially acquired Shaw, the company has moved onto the next phase of this journey. It has started the process of maximizing earnings from its new prize.

The first step was selling the wireless assets to Quebecor, something that had to be done to get the Competition Bureau to approve the deal. Now the company is offering severance packages to long-term Shaw employees and pushing hard to push Shaw cable subscribers to switch to Rogers wireless services.

In a nice bit of timing, Rogers finalized financing the Shaw transaction back in Q1 2022, a time when interest rates were much lower than they are today. It also has almost all of its debt locked up over the long-term, with an average term to maturity of more than 11 years.

Rogers also has plans to help pay down the debt taken on to acquire Shaw, including consolidating operations, selling off excess real estate, and the aforementioned voluntary layoffs.

The company updated its 2023 guidance at the end of March, right around when the deal closed. It told investors it expected revenue to increase by 26-30% in 2023, with adjusted EBITDA to grow by 31-35%. It translates into free cash flow of between $2B and $2.2B, or a range of $3.96 to $4.36 per share. That works out to free cash flow growth of some 13% year-over-year, and that’s just on the low end.

Analysts think 2023 is just the beginning of sustained earnings growth. Here’s what the street expects Rogers to earn over the next three years:

2023 - $4.692024 - $5.642025 - $6.59

Those are normalized earnings, and will strip out any costs associated with the Shaw transaction.

Here’s what analysts expect for free cash flow per share:

2023 - $4.182024 - $5.582025 - $6.58

So what gives? Why are analysts so bullish?

There are a few reasons why the street believes Rogers can significantly grow its bottom line over the next three years. The company has consistently told investors it expects significant synergies once it has digested the Shaw acquisition. It is also poised to benefit from strong immigration numbers; after all, these people need wireless coverage.

Another piece of low hanging fruit is Rogers’s stake in Cogeco. It built up a 41% stake in Cogeco and a 33% stake in Cogeco Communications as part of a failed takeover bid in 2020. Rogers has held on to these shares ever since, and would net approximately $1B if they sold. However, Rogers has had an investment in Cogeco for decades now, with the anticipation it would eventually purchase its Quebec-based cable rival.

Even if Rogers is successful in growing earnings, investors shouldn’t expect the dividend to increase immediately. Any excess capital will be first dedicated to debt repayment. Only after the dent falls to about 4-4.5x EBITDA will it start to look at other options, including raising the payout.

This means we’re not likely to see any meaningful increases to the dividend until 2025, and even then, Rogers might prioritize something else by then.

The bottom line

Rogers trades at a lower valuation than its peers because of the Shaw deal risk, as well as disappointing earnings growth over the last half dozen years. The very public family feud sure didn’t help, either.

This caused many investors to dump the stock and put that cash somewhere else.

This combination of low expectations and solid earnings growth could very easily usher in a new phase of prosperity for Rogers shareholders. If we value the whole operation at 15x 2025’s projected earnings, we’re looking at a $100 stock in just 2.5 years, plus dividends. And that’s on the low end. I think the stock could easily trade at 20x earnings, which puts the potential price in the $120 to $130 range in the next few years. That’s a double compared to today.

There’s risk the company doesn’t execute, sure, but barring huge operating losses I doubt the stock goes much lower from here. That creates a scenario where there’s really solid upside potential without a lot of downside risk, something I really like to see.

Disclosure: Author may have positions in securities mentioned. Nothing written above constitutes financial advice. Consult a qualified financial advisor before making any investment decisions.

To upgrade your subscription — which includes full author ownership disclosure on securities mentioned and two model dividend portfolios — click the link below.