- Canadian Dividend Investing

- Posts

- The Dividend Sweet Spot

The Dividend Sweet Spot

Why I love stocks with medium yields and medium growth

Dear investor,

The world of dividend investing is filled with investors who, largely, make up two groups.

The first group is those who strictly look at yield. The logic is simple — if a 5% yield is good, a 15% yield is even better.

These are the types of folks who give dividend investing a bad name, the ones who always seem to suffer whenever a high yield stock slashes its payout.

The second group is pretty much the exact opposite. These are investors who put their capital into what I like to call token dividend stocks. These are companies that pay a tiny dividend, choosing instead to reinvest virtually all their earnings back into the company.

There’s nothing wrong with that strategy, btw. The only issue I have with it is calling it dividend investing and then stuffing your whole portfolio full of these stocks. It’s a growth strategy in dividend clothes, and will suffer much the same fate in a downturn.

Instead, I choose to focus much of my portfolio in the massive middle ground between the two, stocks that offer a strong combination of current yield today, with dividend growth tomorrow.

Let’s take a closer look.

What exactly are medium dividend stocks?

Medium dividend stocks are the ones that offer a decent yield combined with solid growth potential. But they often get forgotten about because they don’t really star at one thing.

Let’s do a little comparison, breaking down each category.

Typically, a high yield stock is anything that yields higher than 5-6%. They don’t tend to offer much growth, choosing instead to pay out most of their earnings back to shareholders. The issue here is when these companies stumble and the dividend gets interrupted. That’s a retirement killer right there.

High growth stocks are the opposite. They usually yield less than 1%, while offering high dividend growth. Their dividend payout ratios are usually below 20% of earnings and they tend to trade for anywhere from 25-40x earnings.

Then we have a middle ground, which doesn’t get much attention. This part of the market is massive, and is filled with everything from small companies in niche-y sectors to some of the largest companies in the world. They yield anywhere from 2-5%, depending on how much the market loves them at that particular moment. And they still offer decent growth potential, although that may not be obvious at the time.

These are the stocks I like, especially when they’re unloved by the market.

Investing got a lot easier for me once I realized I wasn’t in the outwit the crowd business.

— Canadian Dividend Investing (@CDInewsletter)

12:29 AM • Nov 27, 2024

I’d much rather put my money in a straightforward idea than trying to beat the market using something complex. Simplicity is best.

Why do I like them so much?

As much as I call myself a dividend investor, what I really am is more of a dividend value investor.

I like finding solid, blue-chip dividend stocks and then buying them when the market hates them. When done right, this one move can both maximize the amount of income I can expect from an investment, and increase my chances of achieving market-beating capital gains.

The strategy works because I’m buying when shares are cheap, which boosts overall returns in the following ways:

It locks in a better dividend

You get capital gains from the stock rising from its current depressed valuation to something more typical

You then get long-term capital gains from the company growing its bottom line over time

These opportunities will always exist, too. The average investor hates buying something when it’s down.

There are hundreds of posts in the Canadian Dividend Investing archives, good stuff that the majority of new subscribers haven’t seen yet. This section will highlight one of these posts, each and every week.

This week is my post on the massive tax advantages if your only income is Canadian dividend income. And even if you’re getting CPP/OAS in retirement, how dividend income is still ridiculously well taxed.

My favourite example

My favourite example of a medium dividend stock is Royal Bank (TSX:RY).

Royal Bank has been the largest company in Canada for decades now. It gets temporarily knocked off that perch about twice a decade, which is usually a good indicator the new king has about peaked.

Because Royal Bank has been so dominant for so long, it’s easily dismissed. It couldn’t possibly offer much growth. It’s never particularly cheap, at least compared to its peers. It’s decidedly boring. It seems too easy.

So many investors ignore it. They chase sexier returns somewhere else.

And yet, Royal Bank has consistently delivered between 11-12% annual returns for a very long time, using a combination of:

A 3-4% dividend yield

7% consistent earnings growth

A tiny bit of multiple expansion (if you buy it right)

I believe that Royal Bank will be a decent investment pretty much no matter when an investor buys it. Especially if they dollar cost average into it for years, like my buddy Jim. But it won’t shoot out the lights, nor will it make someone rich in a hurry. So it’s easily ignored.

You know exactly how it works. I’ll pitch a stock, Twitter style. Everything you need to know in bullet form, less than 280 characters.

This week’s stock is Alexander and Baldwin (NYSE:ALEX)

REIT that owns retail, office, & industrial property in Hawaii

Slowly selling off more than 3,200 acres of vacant land

Pristine balance sheet, under 25% debt-to-assets ratio

Barriers to entry in Hawaii

Trades at a reasonable 14x FFO

4.5% dividend, potential for further dividend growth

The Dividend Yield Theory

To really get the full benefit of this strategy, I suggest waiting until stocks like Royal Bank are trading at a bargain.

There are a number of ways you can do that. Some things I look for include:

The stock trades at or near a 52-week low

The valuation is at a five or ten-year low

The dividend yield is approaching a five or ten year high

The Dividend Yield Theory is a ridiculously simple concept that pairs nicely with fundamental analysis to help predict whether a stock is truly cheap.

If you look at a stock’s long-term chart, you’ll discover that it typically spends most of its time hanging out around a certain yield.

Royal Bank, for instance, spends much of its time around a 4% yield. Anything much below a 4% yield, and it’s usually a sign the stock is overvalued. Anything at the 4.5% (or higher) range has usually been an excellent long-term buying opportunity.

By the way, we’re only at a 3.3% yield for Royal Bank today, but there should be a dividend raise this week when it reports earnings. So I’m not sure today’s a good time to buy.

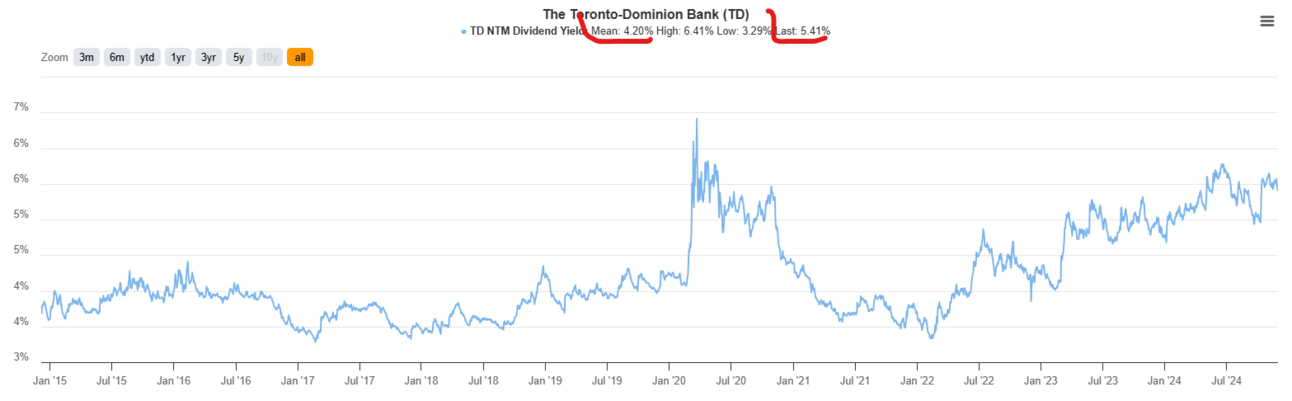

Based on this theory, TD Bank (TSX:TD) is the much more interesting play in Canadian bank land. It has almost as good of performance long-term as Royal Bank, but it’s offering a more generous yield than normal. Its mean yield over the last decade is 4.2%, but the current dividend is 5.4%.

A handful of interesting things I read this week:

Even though Dean and I invest in different ways, he’s one of the smartest guys out there. Here’s an excellent piece he wrote on when to become a full-time investor

My Own Advisor continues to be an excellent source of high quality investment writing (and Mark is a great guy, too). His latest outlines some simple, powerful, and timeless wealth building rules to live by.

This one is a couple months old, but I enjoyed it. A Canadian value investor takes a closer look at the pros and cons of dividend strategies and discovers there’s a lot to like.

S&P Global also makes a compelling case on using dividend growth strategies to grow your portfolio.

An excellent piece by @0xHorseman on Twitter on the Buy, Borrow, Die strategy, and the advantages of borrowing against your portfolio versus withdrawing it.

Premium subscribers get access to our Investment Resources page, which includes the best investment writing Nelson has accumulated from across the web, plus other resources. This week, I added a 60+ page report on what has worked in investing.

Why it works

The concept works because it combines three things that tend to result in pretty good investment results.

The first is a good yield. The whole reason why I’m attracted to dividend-paying stocks in the first place is because dividends deliver returns no matter what the underlying market does. That’s important, especially to those of us who have retired on our dividends.

It’s also a strategy that delivers growth. Most of the stocks in this basket grow their earnings over time, perhaps in the 5-7% range. That’s not very sexy at all, so it gets discounted.

Finally, it’s a value strategy in disguise. Buying such stocks when they’re cheap and then riding them until they’re more fairly valued gooses returns, often by 2-3% per year.

For example, say you bought a stock at 10x earnings. A year later, it trades at 14x earnings. You’ve gotten a 40% return from nothing more than multiple expansion. Even if it trades at 14x earnings for the next decade, you’ll still enjoy about a 3% boost in returns each year from that multiple expansion.

Put the three together, and it could go something like this:

4% yield

5% earnings growth

3% multiple expansion

Equals a 12% annual return for a very long time

This week on Seeking Alpha I wrote about South Bow Corporation (TSX:SOBO), including what I think is a hidden catalyst that could push shares higher.

If you’re on Seeking Alpha, make sure to follow me there. I write 1-2 articles a week.

The bottom line

These medium dividend stocks have slowly become my Kriptonite. I’m a big fan of patiently waiting and adding them to my portfolio when they’re cheap.

The problem is there aren’t that many of these stocks available right now. And the ones that do exist are trading at closer to 52-week highs, not 52-week lows.

Investors have a choice. They can either go out on a bit of a limb and buy these stocks when they’re more expensive, knowing that they’re dollar cost averaging into good companies. Or they can focus their attention on the few names that are beaten up, trying to find a little bit of value in a market that’s increasingly devoid of such stocks.

I look at new stocks every week, and it seems like each time I do I tell myself that the names I’m researching would be much more interesting if they fell by about 25%.

Saying that, I’m still buying, putting some of my dividends back to work on a regular basis. But I’m definitely more selective than I was a few months ago. Back then, it seemed like there were many bargains. These days, not so much.

One more thing

Want to know the stocks I’m buying for my portfolio? I share my buys and sells every week with premium subscribers.

There I share my research each and every week, pointing out stocks that I find attractive and those that I’m not so in love with. I lay out my rationale for each one, saying specifically which ones I like, which ones I don’t, and the reasons why.

I help DIY investors choose excellent dividend stocks. It’s that simple.

Just $200 per year, or $20 for a month if you’d like to try that first. Upgrade today!